Sponsored Programs Accounting

The Sponsored Programs Accounting is committed to providing outstanding customer service and financial support to ensure financial compliance and proper accounting of externally sponsored funds, including:

- Administering and accounting for the research funds received by the University

- Monitoring cash flow and expenditures to ensure financial accountability

- Communicating with funding agencies

- Preparing and submitting financial reports to sponsors and funding agencies

- Requesting invoices for research funds in accordance with sponsor terms and conditions

- Manage closeout of awards

- Aid in documenting cost sharing/matching funds and program income

- Ensuring all research-funded expenditures, budgets, and financial reports are compliant with University policies, the terms of the agreement, and granting agency rules

Invoicing/Accounts Receivable Procedures

Procedures for Invoicing/Accounts Receivable for Externally Sponsored Projects

Sponsored Programs Accounting

Overview

Sponsored Programs Accounting (SPA) is responsible for cost recovery by requesting and collecting funds related to externally sponsored grants and contracts. Ensuring timely receipt of these funds is an important function of Sponsored Programs Accounting (SPA) and requires a combined effort with the PI and research administrator (Department) and sponsor.

Procedures

Invoicing requirements

When new awards are received by the University, SPA will review the award documentation and identify how funds will be received. Sponsors may refer to payment requests as financial reports, rather than invoices; if the financial report triggers payment then it will be considered an invoice-required award. Invoicing information, including Responsible Party and Frequency, is identified in the Notice of Award Document.

SPA Invoicing

The SPA Team manages invoicing for awards identified as Payment Method “Invoicing” and Responsible Party. The Sponsored Accounting Team manages monthly invoicing status lists to identify and meet upcoming invoicing deadlines. The Accounting Team will follow these general invoicing guidelines:

For cost reimbursement invoicing, invoices will be based on transactions that have posted to the University general ledger account for the sponsored project for the applicable invoicing period as of the most recent closed accounting month. Encumbrances will not be included.

Departments are responsible for ensuring that costs are allowable, reasonable and allocable to the project. Please follow the link to access the Federal Award Uniform Guidance @ 2 CFR Part 200 — Uniform Administrative Requirements, Cost Principles, and Audit Requirements for Federal Awards

Departments are responsible for timely posting of expenditures to the appropriate account.

For milestone, fixed price, and fee-for-service, the Sponsored Accounting Team may work with the PI and/or Department to determine when invoicing can occur.

If any unallowable transactions are identified, SPA will notify the Department. Unallowable costs should be moved to an unrestricted funding source as soon as possible.

SPA will not invoice, if:

- the award is not fully executed, i.e. final agreement is not signed (unless the sponsor documents a specific request);

- the budget period has ended and an expected extension or renewal has not been received (unless the sponsor documents a specific request);

- the total expenses for the billing period are zero or a net credit (unless the sponsor documents a specific request), or;

- the cumulative expenditures exceed the budget (unless the sponsor documents a specific request).

Departmental Invoicing

SPA will usually be responsible for invoicing, but Departments may be allowed to handle industry-sponsored or other similar type of awards (Pre-Clinical). When processing new awards, the SPA Contact will identify who is responsible and include the invoicing responsibility in the comment section of the Billing Module.

When the Department is identified as the Responsible Party, the Department is responsible for the following:

- Submitting invoices/requests for payments to the sponsor as defined in the award agreement and as often as allowed.

- Providing copies of invoices to SPA on the same day the invoice/request for payment is sent. If request for payment is submitted through an electronic system, copies of the confirmation in an email indicating Amount, Grant #, Invoice # and Sponsor Name can be provided instead.

- Tracking of outstanding balances and timely follow-up, if necessary, with the sponsor for non-payment.

Payment(s)/checks/remittance advice must be directed to:

University of North Texas Health Science Center at Fort Worth

3500 Camp Bowie Blvd.

Fort Worth, Texas 76107

Monitoring for Payment & Collection

If the Invoicing Responsible Party is Sponsored Accounting Team, they will monitor to ensure timely collection of funding and follow up as appropriate. The SPA guidelines to manage timely accounts receivable are as follows for grant agreements with a standard sponsor payment terms with 30-day payment terms. The SPA team will review the A/R aging report and begin to follow the collection schedule:

- Within 60 days of the invoice, the SPA Team may alert the PI/Department and ask if they are aware of a reason for the delay in payment and send out the “past due” notice to the sponsor outlining the dates in which the invoice was submitted.

- Follow-up will occur every 30 days of the outstanding invoice, the SPA Team will notify the PI and Chair/Dean that collection efforts have been unsuccessful. The PI/or Chair/Dean continues to follow up with the sponsor for the payment status or take additional action as needed. Funding may be suspended if payment isn’t received.

- Within 180 days of the invoice, the SPA Team will notify the Director of Grant Accounting & Fiscal Compliance and Assistant VP of Research.

- Past 270 days of the invoice, the SPA Team may forward a copy of the invoice and past due notice to the legal department for collection.

If payment terms are different than 30 days, contact the Sponsored Programs Accounting Team.

The Department is responsible for covering any uncollectible balances due to unallowable costs, dispute with the sponsor, sponsor bankruptcy or any other reason.

If the award is invoiced by the Department, the Department is responsible for timely invoicing, timely accounts receivable follow-up with documentation, and notifying Sponsored Programs Accounting if there are issues affecting funding or timely collection of funds. The SPA accountants will monitor these awards as part of their regular review. If the accountant determines that invoices are not being sent to Sponsored Programs Accounting, invoices are not being sent to the sponsor timely, or funds have not been received, the accountant will contact the Department to resolve the issues.

Unallowable Costs on Sponsored Projects Procedures

Procedures for Unallowable Costs on Sponsored Projects

Overview of Uniform Guidance

The University of North Texas Health Science Center is required to follow OMB’s Uniform Guidance when determining whether to charge a cost to any grant, contract, or other agreement between the institution and the federal government or federal flow-through entity (federally-sponsored projects). OMB’s Uniform Guidance (2 CFR §200) requires the university to identify unallowable costs and exclude them from any application, proposal, billing, or claim related to a federally-sponsored project. In addition, the guidance provides principles and standards for determining the costs applicable to research and other work performed by the university under federally-sponsored projects. The Uniform Guidance Subpart E – Cost Principles provides standards for select items of costs to be applied in establishing both allowable and unallowable costs on federally-sponsored projects.

In accordance with the Cost Accounting Standard for Educational Initiations (CAS 505), an unallowable cost is defined as any cost which, under the provisions of any pertinent law, regulation, or sponsored project cannot be included in prices, cost reimbursements, or settlements under the federally-sponsored project to which it is allocable.

Procedures for Unallowable Costs

Faculty and staff researchers are expected to maintain due diligence over the financial operations of their research and scholarly activities. This is especially true for activities supported by external sponsors, grants, contracts, awards, and other funding sources. Costs associated with a particular award (grant, contract, etc.) may not be paid using funds from another award. Further, costs that occur after the award/grant expiration may not be charged to the original grant or another grant/award.

The principal investigator is responsible for ensuring that all costs charged are accurate and allowable under the terms of the award/grant/contract. When unallowable costs are discovered as part of award monitoring or project close-out the principal investigator, in collaboration with their department chair, is responsible for identifying an appropriate and allowed funding source (DeptID) to cover the costs. The primary source of funding coverage is from the principal investigator’s internal discretionary account. Should funds in that account be insufficient, the department chair is expected to cover those unallowable costs, again using alternative internal funding sources.

Outcomes for Lack of Compliance

Failure to comply with these expectations by the faculty/staff investigator will result in one or more of the following ramifications at the discretion of the Office of the Executive Vice President for Research and Innovation:

- The investigators’ discretionary account will be frozen until the unallowable costs are addressed/covered by appropriate local funds,

- There will be no further IDC distribution from any award to that investigator’s accounts,

- The Department Chair will be called upon to address the unallowable expense,

- The matter will be referred to the relevant Department Chair, Dean, and then Provost for action regarding financial misconduct.

Write-Offs on Sponsored Projects Procedures

Procedures for Write-Offs on Sponsored Projects

- Overview

Write-offs are necessary to realign current assets on the university’s balance sheet. The procedures will result in more timely recognition of write-offs on the university’s balance and net position.

- Purpose

The procedures will provide guidelines when considering an award for a write-off and how to prepare the package for management consideration. The framework will include the criteria necessary to make the decision, steps to validate the total bad debt amount, the elements to include in the write-off package, and monitoring steps after an award is written-off.

- Who Must Comply

Departmental Administrators

Principal Investigators (PI)

Sponsored Programs Accounting

Office of Sponsored Programs

- Definitions

- NOA – Notice of award – This document is the main agreement between the university and the sponsor. It contains the three elements of a project: scope, duration, and budget. It may also include appendices outlining terms and conditions on expenses and billing if applicable.

- Accounts receivable – Any money owed to the university for appropriate costs incurred related to an award that has yet to be recovered by the university.

- Past due receivable – A past due receivable is a balance unpaid by a sponsor beyond the initial due date established in the NOA or contract.

- Bad debt – It is a Receivable that the university has considered uncollectable.

- F&A – This is Facilities and Administrative Costs, aka Indirect Costs or Overhead. These are costs that are not directly related to a project: (therefore, they should not be in the write- off amount).

- Sponsor – means a federal, state or local government agency, foundation, or private organization that is providing financial support of a Sponsored Project.

- Sponsored Project – means an externally funded activity conducted at or under the auspices of UNTHSC that is governed by specific terms and conditions. Sponsored Projects are usually separately budgeted and accounted for. Sponsored Projects may include projects funded for research, training, education, and other UNTHSC purposes.

- Principal Investigator or “PI” – means the lead on the project who holds fiduciary responsibility on the Sponsored Project.

- Write off – A write-off is an accounting action that removes an asset while debiting an Expense account. The primary use of write-offs in Sponsored Programs Accounting will be to clear receivable balances.

- Procedure

A write-off is the last stage of the accounts receivable collection process for awards that are Uncollectable. Before reaching this stage, Sponsored Program Accounting must follow a collection process to obtain payment from the sponsor. This process includes:

- Follow-up emails on monthly invoices sent to sponsors

- Outreach emails and phone calls to sponsor contacts by Sponsored Program Accounting

- Using the assistance of departmental administrators and PIs as contacts to the sponsor for collection purposes

- In some cases, it may be determined that a legal course of action may be pursued and this will be decided with the Office of Sponsored Programs, Office of Research Budget and Finance, PI/Department/College/Institute and Office of Legal Counsel.

Sponsored Program Accounting will track the award and the receivable balance using the AR Billed Aging report from PeopleSoft. If the Receivable remains open after nine months (270 days), a write-off may become necessary to remove the Receivable from the books.

At any point in the process, the sponsor can contact the university and communicate they will not satisfy the Receivable owed. There are three possible reasons for a sponsor not to pay a receivable:

- An error by the Division of Research and Administration Central Offices – Examples:

- Improper invoicing due to missed deadlines

- Sponsored Programs administrative error

- An error by PI/Department Administrators – Examples:

- Incomplete reporting or reports missing to sponsor

- Not completing all requirements for the scope of the project

- Failed to provide information to Sponsored Program Accounting on time

- Billing for costs not allowed by the sponsor

- An issue with the sponsor – Examples:

- Bankruptcy

- Unwillingness to pay

When this occurs, the Receivable is considered uncollectable, and the university should stop the collection process and work with the sponsor for an amicable solution. If the sponsor is unwilling to work with the university or the sponsor cannot work with the university, Sponsored Program Accounting should write-off the outstanding balance.

- If the fault is by Sponsored Programs Accounting, the write-off receivables will go against the Sponsored Programs Accounting Reserve Account – A write-off package must accompany the write-off journal entry.

- If the Department Administrators or the PI’s are at fault, Sponsored program Accounting will charge the PI Non-Sponsored Project (NSP) for the final receivable balance. If the PI NSP does not have enough funds, the PI should work out a resolution with their chair to remedy the receivable balance. A support memo must accompany the journal entry.

- If a sponsor is unable to pay a receivable balance due to reasons beyond their control, such as bankruptcy, the university should write-off the receivable against its bad debt expense. However, before doing so, Sponsored Program Accounting must ensure that all possible efforts have been made to collect the outstanding balance. A support memo must also accompany the proposed write-off journal entry. This is to ensure that the university’s bad debt expense is accurately charged only after all attempts to recover the outstanding balance have been exhausted.

The Sponsored Programs accountant must do a complete reconciliation to determine the exact receivable amount for the write-off. The accountant will finalize all expenses and settle the budget, bringing the award to a point where the last piece would be a presumed payment to clear the receivable balance. This amount is a final receivable balance.

The final receivable balance contains both direct and indirect costs, if applicable. The F&A portion of the balance will not be written off) The Accounting Manager should review the final reconciliation and submit it to the Director of Accounting and Fiscal compliance for approval.

The write-off support memo should consist of five parts:

- Sponsor name

- Write-off amount (total, direct, F&A)

- A brief narrative of the reason for the write-off.

- Evidence of multiple collection attempts.

- Appropriate signature authorizations

Along with the supporting memo should be back-up documentation. Examples of back-up documents:

- NOA cover page plus section indicating billing and payment terms

- Unpaid invoice(s)

- Email correspondence to/from sponsor

- Bankruptcy notice (in case of bankruptcy)

- Responsibilities

Sponsored Programs Accounting

- Ensure Sponsored Program Accounting personnel followed all collections processes before considering write-off.

- Act as liaison between the sponsor and the department to reach an amicable agreement and avoid write-off.

- The Accounting Director/Manager creates the write-off support memo for the JE.

Departmental Administrators

- Help facilitate an amicable solution to a collections matter to avoid the write-off

- Work with Sponsored Programs accountant to settle award to final receivable balance

- Support Sponsored programs Accounting with any essential documents necessary for the write-off package

- Office of Sponsored Programs

- Monitor sponsors with awards in the pipeline to ensure they do not owe a bad debt to the university

- Alert Sponsored Programs Accounting of a sponsor with a write-off on file and is attempting to back a new agreement.

Indirect Cost (F&A) Recovery Procedures

Updated Indirect Cost (F&A) Recovery Procedures as of December 1, 2023.

Procedure for Management Regarding Applications for Research Funding (grants, contracts, etc.)

Indirect Costs (IDC)

Indirect Costs are also known as Facilities and Administrative costs (F&A) as defined by federal Uniform Guidance. F&A costs are those incurred by a recipient for a common or joint purpose benefiting more than one cost objective, including utilities, building and lab management, telephones, libraries, grant administration support, maintenance, and other services that support and enable research at our institution.

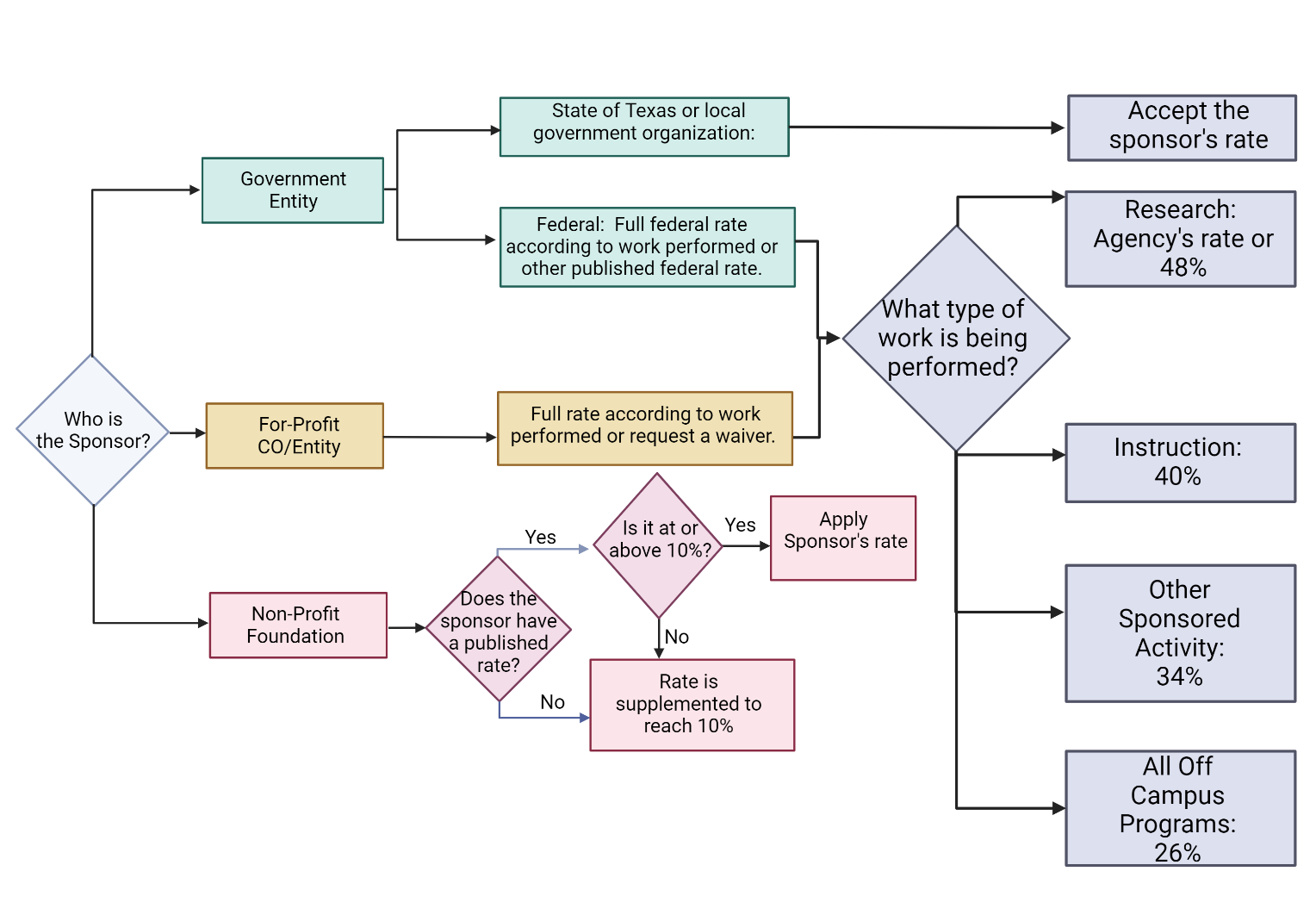

The Decision Flow Chart below describes IDC rate determination:

Allocation and Use of IDC Funds

It is the policy of the University to use, wherever possible, IDC funds to support the sponsored research activities of its faculty, students, and staff as a way to contribute to the pursuit of knowledge, the enhancement of student learning, and the promotion of the common good. Thus, the University will allocate a percentage of indirect costs (Facilities and Administrative costs) to Principal Investigators (PIs), Project Directors (PDs), Departments, Colleges/Schools, the Office of the Executive Vice President for Research and Innovation (EVPRI), and the University Chief Operating Officer (COO) to help support the research enterprise, research training and the overall research infrastructure at HSC.

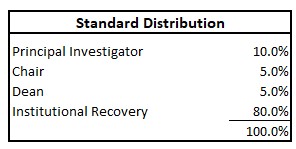

Portions of the recovered indirect costs will be returned to the PI/PD, Department, College/School, EVPRI’s Office, and general operating budget according to the distribution plan described below.

Distribution of Indirect Costs

Previously, the distribution of IDC, published on the Research Division website, was as follows:

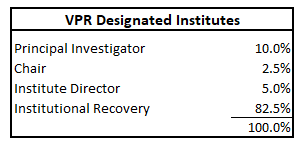

Recognizing a broader need and interest for research engagement, a new distribution model now allocates IDC to the Chair and Dean at the same amount for DRI-recognized Institute awards as for Non-Institute awards; the intent is to support the administrative cost associated with supporting faculty receiving externally funded awards. The new model is shown in the Table below.

| Role | DRI-recognized Institute | Non-Institute |

| Principal Investigator (PI) or Project Director (PD) | 10% | 10% |

| Dean of College or School | 5% | 5% |

| Department Chair | 5% | 5% |

| Institute Director | 5% | 0% |

| Institutional Recovery | 75% | 80% |

The PI/PD’s account will be set up as a discretionary account. The funds will remain in that account for as long as the PI/PD is employed at HSC. Once the PI/PD indicates that they are leaving the University, their F&A Account funds will go into conservatorship (i.e., all expenditures will require the Dean’s and Chair’s approval). When the PI/PD leaves or retires from the University, any unexpended funds remaining in that PI/PD’s indirect cost fund will be returned to the department.

Accountability for Distributed Indirect Cost Dollars

While the indirect cost rate is established based on facilities and administrative expenses, the University has the discretion to re-invest these funds towards the research and scholarship enterprise. The University’s standard distribution of indirect costs recognizes the shared responsibility between central administration, academic units, research centers, and faculty in supporting research and other scholarly activities at HSC.

The following guidelines provide the parameters for the use of this allocated fund:

Program Incentives may be used for research/training/faculty development-related expenses, including student stipends, professional travel for the PI(s) or PD(s) and students, and teaching and student-learning enhancement initiatives. Use of funds is at the discretion of the PI(s) or PD(s). Acceptable uses include the following:

- Research equipment or laboratory-based materials and supplies.

- Student stipends or research assistants plus related benefits (e.g., FICA, Worker’s Compensation) to conduct research.

- Fees for laboratory analyses, whether in Core Labs or external facilities.

- Travel expenses to conduct research (e.g., research library or collection, field site, conferring/working with collaborators).

- Travel expenses for PI/PD or student presentations at professional meetings

- Expenses for a PI/PD to attend professional research, training, or educational activities.

- Equipment purchases or maintenance.

- Student/employee labor costs during the academic year (e.g., work-study).

- Computer hardware and software (procurement must be coordinated with Information Technology Services).

- Miscellaneous expenses, including library acquisitions, journal subscriptions, society membership fees, publication costs, postage, copying, etc.

Note that IDC discretionary funds distributed to a PI, PD, Chair, Dean, or Institute Director may not be used to provide any form of salary increase to that same person (thus, one cannot give oneself a raise using discretionary funds they manage/control) and must comply with all state and federal laws, funding agency Uniform Guidance, UNTHSC policies and UNT System and Regent Rules.

Carry-Over of IDC Discretionary Funds

Discretionary funds derived from IDC recovery may carry over from year-to-year. However, it is the intent that such IDC funds are re-invested into the research enterprise and not overly accumulated. The maximum amount that may be retained year-to-year is $250,000. In the event that the amount is expected to exceed that limit, the holder of the account must provide to the EVPRI a detailed specific written explanation for the need to retain such an amount, and what future use is planned for the funds. A one-page proposal of how the retained funds will be used will be submitted to the appropriate Dean and EVPRI for approval. Failure to do so within 30 days after the end of the previous fiscal year will result in a transfer of retained (carry-over) IDC above the $250,000 limit to the general university account.

In either case, written approval from the EVPRI and the relevant Dean will be needed to avoid or reverse the transfer of those funds to the general university account.

At any time, the Dean and/or EVPRI may request a report to be submitted describing the use and impact of IDC recovered funds during the preceding fiscal year.

In the event that IDC Recovery funds are used for inappropriate purposes, the EVPRI and Dean of the Faculty member may revoke the PI/PD(s)’s access to those funds. In such cases, the allocation will revert to the operating budget of the University. The misuse of discretionary funds will also be reported to the appropriate HSC and UNT System officials for further action as needed.

Operational Procedure and Review

It is expected that before any grant application submission to OSP, relevant Chairs, Deans, and Institute Directors will conduct a due diligence review of financial and operational feasibility in a realistic and holistic manner. As such, there is no “form” or format for such a review. Various levels of leadership are expected to demonstrate operational awareness and oversight to approve research applications and proposals that are not feasible, add additional unfunded costs to HSC, do not align with HSC objectives, or are intended only to satisfy requirements for an individual’s desire for tenure and promotion.

Feasibility reviews will not be required for fellowships, training grants, or awards submitted by PI/PD(s) who qualify as new investigators as defined by the National Institutes of Health.

Chairs and Deans should actively discourage or work with REAP to find alternatives for applications with the following features:

- The non-profit funding agency/entity does not have a published IDC rate.

Note: In cases where a non-profit sponsor has no formal published policy on F&A cost reimbursement, OSP will accept an IDC rate of 10% of the Total Direct Costs (TDC) added to the proposed budget as a line item of administrative costs. If the sponsor does not allow administrative costs, 10% of the Total Direct Costs will be covered by a direct transfer, at the time of award, by departmental/unit local funds to the Office of the Vice President for Research and Innovation and will be distributed in accordance with HSC policy. A memorandum of understanding will be required to agree to this plan and amount prior to processing the proposal application.

- The requested total direct costs (TDC) amount is less than $20,000 annually.

- The proposal offers voluntary cost-share (salary and fringe benefits) in excess of 1% effort for any member of the project team.

- The proposal requires mandatory cost share (salary and fringe benefits) that exceeds the total direct cost dollar amount requested.

- The proposal application requests a waiver of all or some of the appropriate federally negotiated IDC rates or amounts. Note that there are NO waivers of IDC.

Note: For-profit or industry sponsors are expected to provide indirect cost recovery that equals the amount that would have been recovered through the application at the University’s federal IDC rate. In situations with a for-profit or industry sponsor having a published IDC rate or policy of less than the federally negotiated rate or no published IDC policy, the relevant IDC must be covered by the principal investigator, department chair, or dean or a combination thereof.

All Department Chairs and School/College Dean or Institute Director over the PI/PD are expected to conduct a thorough and thoughtful feasibility review of the grant and contract proposals emanating from their unit before signing off and submitting those applications through OSP.

Such reviews by leadership – other than the proposed research team leader – should be conducted as early as possible in the stage of development, especially concerning appropriate budgeting, funds requested, and practical feasibility (i.e., can the study be done with the personnel involved, in the time frame proposed, with the funds requested, etc.).

Only after this feasibility review is conducted and determined suitable for further action should it be sent to OSP processing (no “form” needed).

Waivers of Indirect Costs (Facilities and Administrative) or Applications involving IDC rates lower than federally negotiated rates

An F&A cost waiver is an institutional decision that F&A costs will be applied at a rate lower than the University’s negotiated agreement.

Indirect Costs are “real costs” to the institution. Therefore, published F&A rates of sponsors are NOT waived nor reduced at the University of North Texas Health Science Center.

Using IDC as Cost-Share

IDC, as a cost-sharing mechanism in grant applications requiring cost-share, is not allowed.

This standard operation procedure is linked to UNTHSC Policy 8.107 Sponsored Programs.

Summary Points:

- IDC Waivers are NOT allowed

- Voluntary Cost Share NOT allowed

- Use of IDC for Mandatory Cost-Share NOT allowed

- TDC < $20,000 per year NOT allowed…with following exceptions:

- Applications from graduate students, postdoctoral fellows

- Applications from Early Career Stage and New Investigators (as defined by NIH)

- Applications to “high-visibility” sponsors such as American Heart Association, American Cancer Society, various foundations allowed, primarily to generate pilot data and demonstrate prior success and credentials for subsequent “major sponsor” applications

- Note: Recurring reliance on only seeking “small grant awards” is discouraged: NIH has small grant programs (for example, R03 provides $50K plus full IDC per year for 2 years)

- All state of Texas and Federal negotiated/stated rates apply, but will honor non- federal sponsor published IDC rates

- If no published IDC rate, apply 10%

- If IDC rate < 10% then the Chair, PI, Dean must offset to 10% using non-state funds, with the following exceptions:

-

- Applications from graduate students, postdoctoral fellows

- Applications from Early Career Stage and New Investigators (as defined by NIH)

- Project fits in with HSC mission-oriented research program (Whole Health, Health Disparities) and the sponsor has high visibility or national reputation (e.g. AHA, ACS, RWJF, Ford Foundation, Pew Charitable Trust, etc.) Note: Professional associations with 0% IDC do not meet this criterion.

- Educational research is exempt from these requirements

- Annual IDC “balance retention” greater than $250,000 requires written justification for EVPRI review and approval

- Chairs/Deans must show due diligence prior to sign-off, essentially an unofficial feasibility review to address all of the above

Additional Resources

Social media